Debt Consolidation

Put high-interest debt behind you with a Acceptance Capital Services Debt Consolidation Loan.

What is a Debt Consolidation Loan?

A debt consolidation loan is an unsecured personal loan that can help you consolidate different types of debt. Whether it’s high-interest rate credit card debt, medical bills, or auto loans, consolidating with Acceptance Capital Services could be a smart way to help you pay off your balances all at once.

If that sounds like a good deal, here’s more: A debt consolidation loan can also free you from paying higher than average interest rates, simplify life by reducing the number of monthly payments you manage, and save you money on annual fees.

Debt Consolidation Loan Interest Rates

Debt consolidation loan APRs vary from lender to lender and often range between 4.99% to 36%. Most personal loan lenders offer fixed rates for the life of the debt consolidation loan, so unlike variable rates on credit cards, the rate you pay on a personal loan for debt consolidation won’t change.

Is a Debt Consolidation Loan right for me?

Will the loan save you money? If your answer is yes, there’s a good possibility it could be an option worth pursuing. In addition, ask yourself the following questions to determine if a debt consolidation loan could be a good fit for you:

- How much debt do you have, and how does it compare to your income?

- What is your credit score, and is it good enough to qualify for a low-interest rate?

- Will you be able to pay back your loan without running up additional debt?

- Will you be able to afford monthly payments on a consolidation loan?

If you have a healthy debt to income ratio (36% or less), your credit score is high enough to qualify for low-interest rates, and you have the ability to pay back the loan on time, consolidating with a debt consolidation loan could be exactly what you need to get your finances back on track.

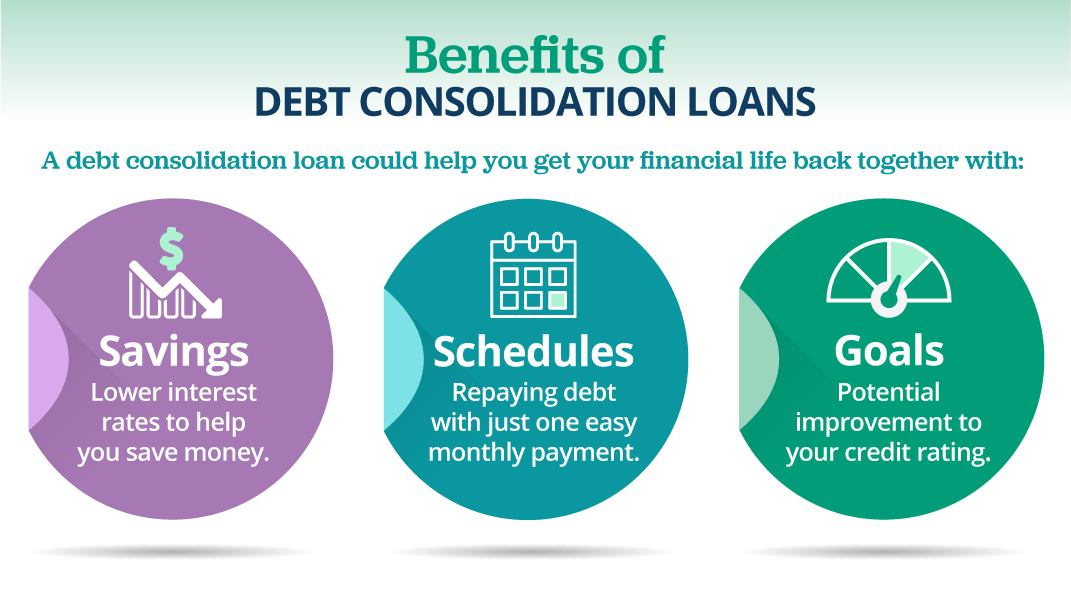

The Pros to Debt Consolidation

![]() Consolidate all of your outstanding balances, resulting in one monthly payment.

Consolidate all of your outstanding balances, resulting in one monthly payment.

![]() Debt consolidation loans may offer lower interest rates.

Debt consolidation loans may offer lower interest rates.

![]() You can pay off debt quicker.

You can pay off debt quicker.

![]() You can avoid credit damage if you manage your consolidation loan responsibly and don’t run up additional debt.

You can avoid credit damage if you manage your consolidation loan responsibly and don’t run up additional debt.

See your rates in just minutes!

Why Choose Acceptance Capital Services for Debt Consolidation?

We’re committed to making money accessible so you can live your best life. A Acceptance Capital Services debt consolidation loan is just one way you could get on the path to financial freedom.

- Build Your Nest Egg Save money over time, with fixed interest rates on a debt consolidation loan. Use what you saved to build your nest egg.

- Easy, Fast & Friendly Service Quick application process with access to funds in as little as one business day. Check your rate without impacting your credit score.

- Simplify Life Solve major financial challenges with quick access to borrow up to $35,000.

A Debt Consolidation Loan with Acceptance Capital Services is as Easy as 1, 2, 3

Explore Your Options

Read reviews, learn about what you can expect and see what you can fit into your budget.

Apply

Gather your financial information and apply online–hassle free.

Get Approved

With Acceptance Capital Services you can find out if you’ve been approved for personal loan offers in just a few minutes.

Find Out How Much You Could Save

Considering applying for a personal loan to consolidate debt but want to know what your monthly payment and annual percentage rate (APR) might be before you apply? Give our personal loan calculator a try. It’s simple – just use the slider to select your requested loan amount, click on your desired loan terms, then select your current credit score to the best of your knowledge. Our calculator will handle the rest.

Check Your Rate for a Debt Consolidation Loan

There’s no impact to your credit score

We’re here to make things as simple as possible for you so you don’t have to think about all of the logistics that come with debt consolidation.

Acceptance Capital Services personal loan amounts can range from $2,000 to $35,000 with Annual Percentage Rates (APRs) from 5.99% to 29.99%†. Our fixed interest rates, manageable monthly payments, and set repayment terms could help you pay off debt faster — giving you a chance to catch your breath and focus on the important things in life.

If you have a positive credit rating and a good payment history, congrats! You’ve worked hard for it. As they say, hard work pays off – the better your credit, the better your chances are of qualifying for a low-interest rate on a debt consolidation loan.

If your credit score isn’t at its best, don’t lose hope – credit scores can change in as little as 30 days. Need some help? That’s what we’re here for. Straight Money Talk with Acceptance Capital Services gives you plenty of resources to help you learn how you could build or improve your credit.

Debt got you feeling like you’re stuck treading water when you should be swimming laps? Take some time to check your rate and see if you qualify for a Acceptance Capital Services debt consolidation loan today.